Auditors In The Hot Seat.

With Lehman’s ‘Repo 105’ accounting maneuvers going unnoticed for an extended period of time, the most logical next thought is the role that public accounting firms play in a company’s financial statements. Lehman’s examiner put Dick Fuld and Co. (namely Messrs O’Meara, Callan, Lowitt) including Lehman’s public accounting firm, Ernst & Young in the hot seat.

The Sarbanes-Oxley Act (2002) was enacted not only to ensure that the CEO and CFO certified as to the state of internal controls within their organization but it also established audit procedures on the public accounting firms themselves. The Public Company Accounting Oversight Board (or PCAOB, sometimes jokingly pronounced “Peek-a-boo”) is a private-sector, non-profit corporation created by the Sarbanes-Oxley Act, a 2002 United States federal law, to among other things, oversee the auditors of public companies.

The PCAOB carries out inspections on the audit procedures of public accounting firms. The results of these inspections are then published for the consumption of the general public. I thought it would be interesting to highlight some of the ‘issues’ raised by the PCAOB against the big public accounting firms. Unfortunately, companies where such audit inspections have been conducted are not named, but you get a sense of the type of violations committed by these accounting firms.

For 2009

Deloitte- There were multiple adverse observations but there was one particular observation that related to allowances for loan losses. For one company, Deloitte failed to perform sufficient procedures to test the issuer’s allowance for loan losses (”ALL”). This allowance was determined using a quantitative model that was designed to be adjusted for recent conditions and information. During the year, the company gathered evidence of deteriorating conditions relevant to the value of its loan portfolio that were in excess of the ALL. According to the published report, Deloitte “failed to perform a sufficient analysis of whether the deteriorating conditions should have prompted further increases in the qualitative adjustments included in the ALL.” In short what this indicates is that the company might not have adequately provided for potential losses in asset values.

Ernst & Young LLP- There were at least two cases where the firm did not perform sufficient procedures to assess the valuation of certain securities. In one of these two cases, PCAOB suggested that insufficient evidence was present to suggest that the firm had sufficiently evaluated the assumptions underlying the company’s valuation of securities. In the other case, Ernst & Young used prices for recent transactions to assess the valuation of the company’s loans. But they did not evaluate whether the loans being valued were of “comparable quality to the loans in the transactions”. And for other other loans, Ernst & Young developed an independent estimate of the value. But such an estimate was based on an incorrect assumption that transactions whose inputs were used were in fact comparable to loan transactions that were being valued. In a third case, the firm failed to perform adequate audit procedures beyond “management inquiries” in estimating the fair value of certain assets that collateralized loans.

What is most alarming is the fact that many of these findings relate to loan allowances or valuations of collateralized assets. Material mistakes here could potentially spell disaster.

Each of the other large public accounting firms were also inspected by the PCAOB. If you are interested in the whole list, click here.

Unfortunately, certain parts of the report are kept private and are not published. These include the results of an inspection of the audit firms’ quality control system which in fact would be critical to understanding the quality of their audits at large companies. It could also indicate the extent to which reliance could be placed on their audit conclusions.

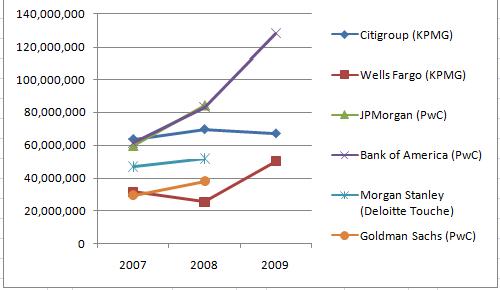

As an offshoot of this research, I thought it would be interesting to take a quick look at how audit fees at the 6 largest banks’ have fared over the past 3 years, starting with 2007.

Audit fees average in the $20-$60 million category. At the highest end is $128 million paid by Bank of America to PricewaterhouseCoopers (PwC) for 2009. In 2007, they were paid $61 million. At the lowest end of the spectrum is Goldman Sachs with $38 million paid to PwC for 2008. 2009 figures are not yet available. Most notable is the absence of Ernst & Young (E&Y). It appears that none of the large 6 banks have E&Y as their public accounting firm of choice. Ernst & Young was Lehman’s public accounting firm until its demise in September 2008.

It is interesting to note that public accounting seems to be one profession that, recession or not, appears to be doing very well. Where else would you find such a quick and steep jump in revenues despite the fact that your customers are not doing well financially?

What is most concerning is whether the inspection reports published by the PCAOB are even read by shareholders or presented to the Board of Directors. As per most Board Audit Committee charters, public accounting firms are expected to present results of the review of their quality control systems to members of their client company’s Audit Committee. But whether this is actually done or not, is difficult to determine given the opacity of reports published by the companies themselves.