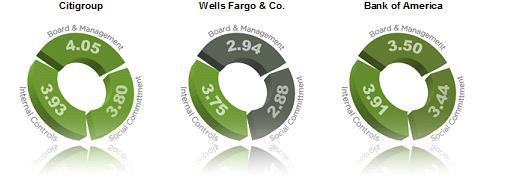

2009 Banking Industry Non Financial Scores - Citigroup, Wells, Bank of America

Lately, Citigroup appears to be putting its best foot forward. Its CEO provided a very confident (albeit doubtful) front during the recent congressional hearings held by the Oversight Panel for TARP. President and CEO of Citi Mortgage Mr. Sanjiv Das also appeared reasonably confident in Citi’s ability to ‘assist’ underwater homeowners in the recent House Financial Services Committee hearing.

It appears that these Citigroup executives are not too far from the mark…and not just based on their behavior or how confident they were at congressional hearings. Based on recent SEC filings and published information, Citigroup appears to have taken a lead over both Bank of America and Wells Fargo so far as InvesGuard’s non financial scores are concerned.

Look at InvesGuard scores for Citigroup, Bank of America and Wells Fargo below:

A legend of the scores and what they mean has been included at the end of this post.

InvesGuard scores and grades companies based on non-financial information. Different parameters are considered including:

1. Number of transactions between the company and its directors (other than director fees) that may give rise to conflict of interest situations.

2. Directors who also perform consulting services for the company resulting into reduced Director Independence.

3. Level of transparency in Board Audit Committee reports.

4. Relevance of experience of Board members especially those who hold Board level finance, credit and risk committee positions in the financial industry.

5. A look at the quality of a company’s guidelines, charters, principles etc under which it operates.

6. Social and environmental factors such as lending practices, emissions, waste management, recycling etc.

For 2009, Citigroup’s chief area of improvement has been its Board of Directors. Although concerns continue over some aspects, the Citigroup Board is stronger than it used to be. Out of 9 parameters or ‘Core’ comparison events between Bank of America, Citigroup and Wells Fargo, Citigroup has scored the highest or shared the highest score for 7 of these ‘core’ events. These core events include such parameters like CEO and senior management effectiveness, aligned director shareholder interests etc.

Of the three companies, Wells Fargo has by far performed the worst on the Board of Directors and Senior Management front. Its poor scores will get even worse for 2010 with the jump in CEO and senior executive pay without any apparent long term strengthening of shareholder value. Hitting it the hardest, is Wells’ absence of a Board level Asset Quality committee. Even its Board level Finance and Credit committees appear to have some directors with less than relevant experience.

InvesGuard’s Internal Control Environment primarily includes a comprehensive review of a company’s Board Audit Committee including quality of this committee’s reports, its members, their compensation, as well as its charter. Conflict of Interest is also considered within the Internal Control Environment category.

For 2009, all three companies did not explicitly prevent their directors from providing consulting services to each of these companies. Providing consulting services has the potential to take away the independent perspective that directors are expected to provide. It could potentially cloud their judgement. In fact, Citigroup paid consulting fees of $100,000 to Director Joss during 2009 in addition to regular director compensation.

For more detailed information on these scores please visit our store at http://store.invesguard.com/ or send me an email at tejus@invesguard.com

Check back later this week when we will be adding final 2009 JP Morgan Chase and Goldman Sachs scores.

Legend for the scores used in the graphs